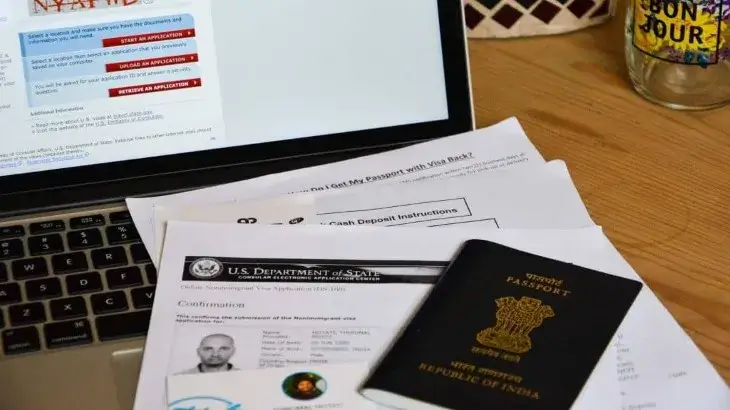

One small step at a time rules to Get Done Indian Passport Attestation From USA

Updated on: 06 May 2023

What is ITIN?

It is a

term for people remaining as an occupant in the USA. Untouchables in the USA

are obliged to pay a specific extent of commitment as well. Notwithstanding

what the situation with the development, chronicled or undocumented outsiders

need to get their ITIN given.

ITIN tends

to Individual Taxpayer Identification Number. This number is valuable for

accuse managing of purposes and it is given by the IRS for example Inner

Revenue Service. It guarantees that individuals including relaxed experts pay

inconveniences paying little brain to them don't have SSN for example Federal

retirement aide Number.

This ITIN

awards the IRS to get cash as these commitments to the central government which

may not be reachable for the public power.

ITIN was

made for charge purposes by the IRS in July 1996. It awards far off nationals,

workers (archived and undocumented) to adhere to the U.S charge rules and for

individuals who are not ready for the Social Security Number.

Also, appreciate

that the Individual Tax Identification Number isn't identical to Social

Security Number. This ITIN number is a 9 digit number. It begins with the

number 9 and by and large has a 7 or 8 number in the fourth digit.

The model can be like this-9XX-7X-XXXX.

In every

practical sense, all outsiders have this number. Undoubtedly, even individuals

who don't remain as legitimate drifters can in this way get an ITIN.

Following is the outline of qualified individuals who ought to recognize

ITIN according to the U.S Tax rule

A

Businessperson in the U.S who is a non-occupant public and is getting the open

extent of benefit from the U.S business and is living in another country.

ITIN

should be given to a far off open understudy who is an occupant of the United

States considering how much days remained in the U.S.

A ward or

perfect partner of a U.S. occupant or real getting through inhabitant.

A ward or

perfect partner of another open on a fleeting visa.

One

requirements to comprehend that ITIN doesn't give work support and authentic

status.

Similarly,

it doesn't give genuine improvement status and its beginning and end with the

exception of an underwriting to be utilized to show that you are a real tenant

of the country.

The ITIN

can't give work support and can't be utilized to show work underwriting on an

I-19 Form.

Part of

cost as p[er the U.S charge rule is necessary for the ITIN holders.

Why ITIN?

ITIN

fosters the examination base and allows more individuals to add to the

commitment structure. Moreover, ITIN holders are not prepared for the

inhabitant's all's advantages. For example, they are not prepared for things

like Social Security Benefits or the Earned Income Tax Credits (EITC).

By the by,

there are preclusions too. Expecting on the off chance that a near individual

changes into an extremely durable occupant that individual becomes ready to get

Social Security later on.

By and by,

everything relied on the total the individual can get the other monetary

advantages. ITIN awards several holders to get the advantages from Child Tax

Credit

What Purposes Does the ITIN Serve?

Premium

bearing Bank Account-Any ITIN holder who doesn't have SSN can open a first

class bearing financial balance.

Driving

License Issuance-Instead of SSN, two or three states permitted to utilization

of the ITIN number for the driving permit reason (driving permit and driver's honour

and state undeniable proof card)

Considered

as Residency Proof-In unambiguous conditions an outcast necessities to show how

long he/she has been remaining in the U.S to get the public power structure

recorded. ITIN can help in such cases.

Does ITIN Is Used to Monitor the Undocumented Immigrants

in the Country?

No. The

ITIN isn't a device for development essential. This correspondence is organized

exclusively for charge segment.

Also, the

restricted Intel of the promising newcomer isn't allowed to the development

need relationship by the IRS. U.S charge framework guarantees the inhabitant's

security since occupants need to give a great deal of private data to the IRS

and remaining mindful of its protection is basic for the useful execution of

the program.

As shown

by section 6103 of the Internal Revenue Code, the IRS isn't upheld to uncover

the occupants' data to government affiliations.

Basically

the divisions, for example, Treasury divisions are blocked as important to be

obliged the appraisals associating with inconvenience affiliations or in the

event of the court interest

The Process to Apply for ITIN

1) Filling

the kind of W-7 and submitting it to the IRS with the full scale cost structure

records.

2) When

the application is embraced ITIN is shared through an email. The promising

newcomer need not go very close to gather it.

3)

Applicants need to present two or three reports they are as indicated by the

going with

ID of the Applicant (independent report) *

Public

Identification Card (should show a photograph, name, current region, date of

birth, and end date)

·

U.S. Driver's License

·

Typical Birth Certificate (expected forwards

under 18 years old)

·

New Driver's License

·

U.S. State Identification Card

·

New Voter's Registration Card

·

U.S. Military Identification Card

·

New Military Identification Card

·

Visa

·

U.S. Citizenship and Immigration Services

(USCIS) photograph obvious check

·

Clinical Records (wards just - under 6)

·

School Records (wards just - under 14, under

18 if an understudy)

These

records are returned to the candidate in the extent of 60 days of receipt and

are managing the W7 structure.

Different

specialists from IRS confirmation and occupant Assistance carters help the

contenders simultaneously.

As

indicated by the 2015's standard and the change of the standard of 2012 heading

from the IRS, all the ITINs gave before December 31, 2012, should be

revalidated true to form.

In the

event that someone else has the ITIN at any rate does exclude it for three

moderate years, it will accordingly pass and revalidation is ordinary in such

cases.

ID Attestation to Get ITIN from USA

It is

fundamental to have your unmistakable verification duplicate looked at from the

Ministry of External Affairs of the country. It shows that the duplicate is

good 'ol fashioned in adherence to the chief document. It is the basic archive

in dealing with the ITIN application.

Similarly,

conspicuous evidence attestation is one of the fundamental structures of

legitimization in which an endorsement stamp from the consigned authority is

obtained. It should be finished from the check gave country for example India.

The

demonstration of support is perceived to pronounce the authenticity of a report

which is performed by the reliable power first and consequently different

prepared experts. Conspicuous confirmation duplicates check is referenced

various purposes and it isn't unequivocal, it will transform from a need to

need and country to country.

Getting an

ITIN in the US is maybe of the most by and large saw explanation behind visa

endorsement. Another model is that in a few nations giving affirmed duplicates

from visa nearby a huge driving award to drive in a far off nation is

referenced.

PEC check

associations have 6+ broad stretches of commitment with getting speedy

apostille and endorsement associations for overall IDs and different advertisements,

individual and instructive reports too.